The age of digital platforms:

In the age of digital platforms, disruptive innovations have transformed industries, revolutionizing the way people access services and goods. Companies like Uber and Airbnb have been at the forefront of this revolution, reshaping the transportation and accommodation sectors. However, there's a new player on the horizon that promises to become even bigger: RiskShare. With its unique approach to risk sharing and cost reduction, RiskShare has the potential to surpass Uber and Airbnb's market reach. Let's explore the similarities and advantages that position RiskShare as a formidable contender in the global market.

A Shift from Traditional Models:

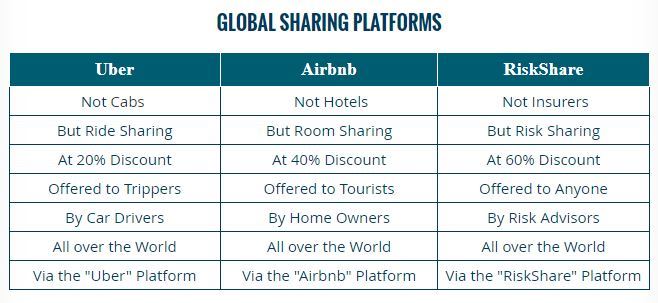

Just as Uber disrupted the traditional cab model and Airbnb transformed the hotel industry, RiskShare introduces a groundbreaking paradigm shift in the insurance sector. RiskShare replaces traditional insurers with risk advisors, who facilitate risk sharing among participants. By eliminating traditional insurers, RiskShare eliminates costs, profits, and taxes, making insurance more affordable and accessible to a wider audience.

Global Reach:

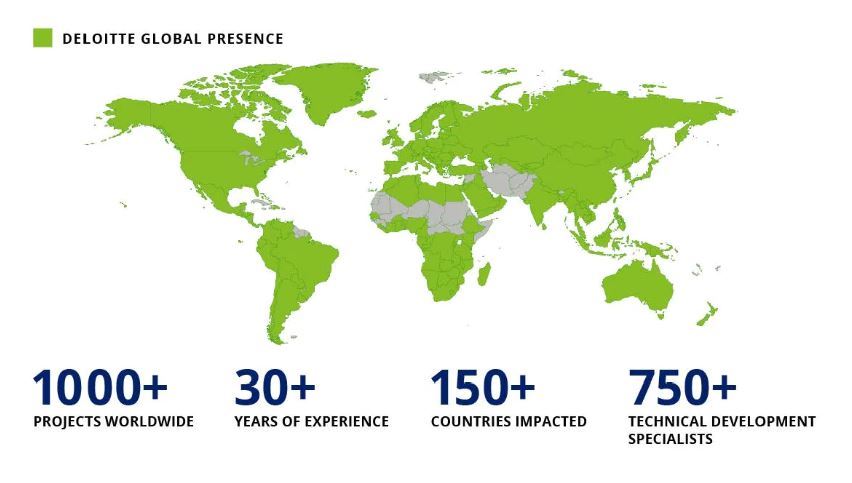

One key similarity between RiskShare, Uber and Airbnb is their global presence. Uber and Airbnb operate in numerous countries, connecting car drivers with trippers and home owners with tourists worldwide. RiskShare aims to follow suit by establishing its platform globally, allowing participants from every corner of the world to engage in risk sharing. This expansive reach opens up a vast market potential for RiskShare, surpassing the localized nature of traditional insurance providers.

Cost Reduction:

Uber and Airbnb gained significant traction by offering their services at discounted rates compared to traditional alternatives. Similarly, RiskShare aims to disrupt the insurance market by providing risk sharing at a remarkable 60% discount through its platform. By eliminating the profit-driven motives of traditional insurers, RiskShare passes on the savings to participants, making insurance affordable and attractive to a larger number of individuals.

Participant Engagement:

One factor that sets Uber, Airbnb and RiskShare apart from their predecessors is the active engagement of their participants. Rather than acting as mere consumers, individuals can become drivers, hosts, or risk advisors, actively contributing to the platform and its community. This participatory approach not only empowers users but also fosters a sense of ownership, loyalty, and collaboration. RiskShare's emphasis on participant involvement creates a robust network effect, propelling its growth and expansion.

Disruptive Potential:

Uber and Airbnb disrupted traditional industries by leveraging digital technologies and the sharing economy. Similarly, RiskShare introduces a disruptive concept in the insurance realm, harnessing the power of risk sharing and blockchain technology. By decentralizing the insurance process and providing a transparent, secure, and efficient platform, RiskShare has the potential to revolutionize how individuals protect themselves against risks globally.

Conclusion:

While Uber and Airbnb have redefined their respective industries, RiskShare is poised to make an even greater impact on the global stage. With its unique approach to risk sharing, substantial cost reductions, global reach, and participant engagement, RiskShare is positioned to become a dominant force in the insurance sector. By leveraging the principles that made Uber and Airbnb successful, RiskShare has the potential to reshape the insurance landscape, offering affordable and accessible coverage to individuals worldwide. As the world becomes increasingly interconnected, RiskShare's rise as a market giant seems inevitable, solidifying its place alongside the disruptive pioneers of the sharing economy.