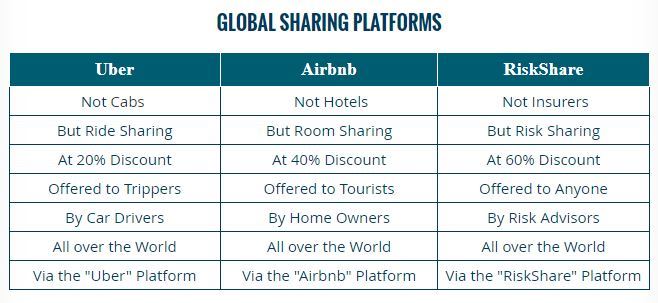

Are you an execution-focused entrepreneur with a drive for success and a passion for innovation? Want to launch a world-class internet platform with limitless potential, drawing comparisons to the likes of Uber and Airbnb? Do you possess exceptional commercial skills and an undeniable charisma, as well as a natural affinity for insurance and franchising? And, most importantly, do you have the ability to think big, start small and scale fast?

Then RiskShare presents a rare and irresistible opportunity for you to become a successful UNICORN founder and reap significant financial rewards in just five years. Join the revolutionary insurtech platform that's set to shake up the insurance industry and make history. You just need initial funding, assemble a commercial and technical staff, recruit a network of independent advisors, and plan promotional campaigns. Don't miss this once-in-a-lifetime chance to be at the forefront of industry disruption. RiskShare will become bigger, more agile and more profitable than Uber and Airbnb with the right man or woman at the top.

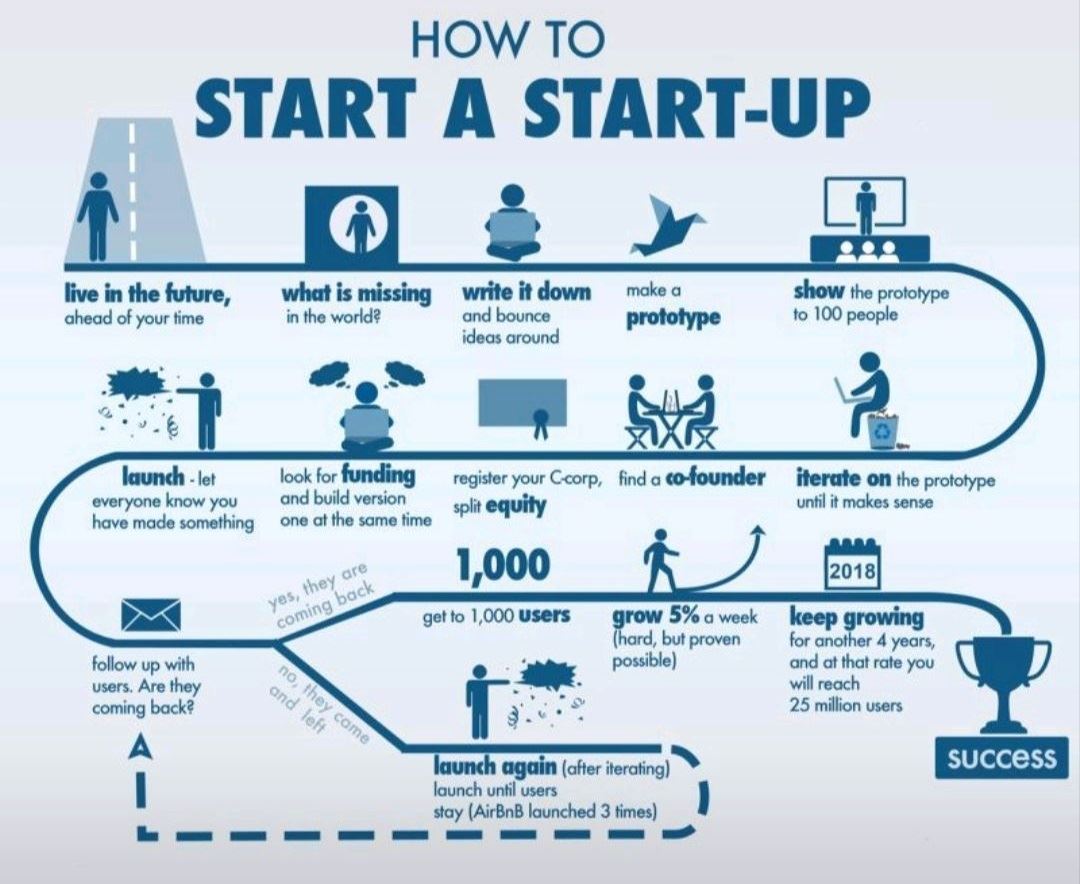

It’s important to understand that this role involves starting a company, comparable to Uber or Airbnb, from scratch. As the core of this venture, you need to build a strong, capable team because no idea or business model can succeed without the right people driving it forward. You will also need to present the project to a global audience, including TV appearances and events for thousands of advisors and government officials. Reach out now and let's get started.

BUSINESS MODEL

RiskShare is the world's first and only true P2P risk sharing platform. With P2P risk sharing, participants pay only for each other's claims without the intervention of an insurer or reinsurer, so without costs, taxes and profits resulting in premiums that are at least 60% lower than traditional insurance.

RiskShare is completely digital. No expensive buildings, no front or back office staff and no bureaucracy. RiskShare involves online networks without legal status, so no regulations and licenses apply. They offer coverage for death, disability, accidents, healthcare, travel, liability, legal aid, damage or loss to car, house and contents. Tagline "Risk ends where RiskShare begins''

The risk sharing is advised and managed by independent advisors who build their own client base through subscriptions and pay themselves a fixed fee per client to the platform. They are the first and only point of contact making RiskShare both extremely digital and extremely personal. And ultimately, clients and advisors are the all-over marketing engine through participant engagement.

The platform allows participants to easily close, pay, claim and cancel risk sharing schemes all by themselves in minutes. The periodic risk sharing payments are variable and automatically (re)calculated daily for each specific risk, to cover claims paid on that day. Advisors conduct client surveys to gather preferences for risk sharing schemes and if desired by the majority, these schemes are introduced. This allows participants to influence the risk sharing terms and payments.

Our 5 year objective is to have networks of a total of one million participants, franchise partnerships of a total of five thousand advisors and many many millions of transactions. With a market value of one billion euros, an exit will be considered.