|

| RiskShare Platform |

PROBLEM: OVERPRICED INSURANCE

One million self-employed individuals in the Netherlands face difficulties obtaining affordable disability protection. This demographic, which plays a vital role in the Dutch economy, encounters unique challenges compared to salaried workers, primarily due to the high cost and stringent terms of traditional insurance options. These options are often too expensive and offer unfavorable terms, leaving many without adequate protection against disability risk during their working life.

SOLUTION: P2P RISK SHARING

P2P risk sharing can address this issue by allowing self-employed individuals to mutually share the risk of disability. With P2P risk sharing, participants pay only for each other's claims without the intervention of an insurer or reinsurer. This eliminates costs ±30%, taxes ±20%, and profits ±10%, resulting in premiums that are at least 60% lower than traditional insurance, making the coverage more affordable and accessible. The P2P risk sharing scheme operates until participants reach retirement age, ensuring they have comprehensive disability protection throughout their working life.

COMPARISON OF TRADITIONAL INSURANCE AND P2P RISK SHARING

Traditional InsuranceProfession: Bricklayer Premium per month: 18 years of age: €159.71 | P2P Risk Sharing

Profession: All professions

Disability: >25% Payment pm at >80%: €2,000.00 Based on degree of disability Waiting period: 30 days Indexing: Inflation Premium per month at average 4%: 18 years of age: € 5.00 |

MARKET SITUATION

The average long-term disability rate among self-employed individuals insured by Dutch insurance companies typically ranges from 1.5% to 2.5%. This variation depends on factors such as age, occupation, and chosen coverage, as reported by KPMG, Dutch Association of Insurers, and DNB.

Currently, absenteeism due to illness is lowest among self-employed individuals at 1.7%, compared to 3.8% for medium-sized companies and 5.2% for large companies. Despite this, many self-employed individuals struggle to afford disability insurance, which they seek at reasonable conditions and costs throughout their careers.

TRUE P2P RISK SHARING

P2P risk sharing offers a solution by eliminating the conflicts of interest and profit drivennes inherent in traditional insurance models. This approach provide disability insurance to millions of self-employed individuals at premiums at least 60% lower than traditional insurers.

For example, assuming 100 in risk sharing participating self-employed individuals, an average absence rate of 4%, and a benefit of €2,000 per disabled person per month, these 100 participants would need to share a monthly amount of €8,000, or €80 per person. The sharing payments are age-related, starting at €5 for an 18-year-old and increasing by €3 annually, up to €155 a month for a 67-year-old.

In P2P risk sharing, there is no traditional insurer or reinsurer involved. The risk sharing payments are used exclusively for claims, ensuring that the interests of the risk sharing participants are prioritized, unlike traditional insurance where unused premiums cover overhead, operational costs, profits, and taxes.

TESTIMONIALS

Sandra from Eindhoven: I was initially skeptical about using a new type of insurance, but RiskShare really surprised me. My premium is significantly lower than before, and when I had a question, my advisor responded quickly and explained everything clearly. The ability to adjust my coverage through a simple survey gives me the feeling that I'm truly in control. It feels great to be part of a more modern way of handling insurance.

Peter from Amsterdam: Due to my disability, I rely on my benefits, and I was worried that managing this would be a hassle. Thankfully, it wasn't! My advisor guided me step by step, and everything went smoothly. I was able to handle my benefits without any stress, and that means a lot to me.

Richard from Utrecht: As a RiskShare Advisor, I couldn't be happier with my decision to join this innovative platform. The ability to offer my clients significant savings on their premiums, combined with the ease of a fully digital process, has made my work both rewarding and efficient. I love that I can focus on building strong, personal relationships with my clients, without being bogged down by the usual bureaucracy and red tape of traditional insurance. The fact that I can earn a substantial income while truly helping people makes this role incredibly fulfilling. RiskShare is the future of insurance, and I'm proud to be a part of it!

HOW THE RISKSHARE PLATFORM WORKS

-

ADVISORY SUBSCRIPTION: Local RiskShare Advisors, anywhere in the world, working together in local franchise partnerships, advise the local public on p2p risk sharing, and offer to organize this for them after they subscribe to a daily cancellable advisory and management service. You can change advisors at any time.

-

RISK SHARING CLOSING: After taking out the subscription, the participants / members / clients or whatever name you prefer, can instantly close, pay, claim, and cancel the desired risk sharing schemes all by themselves in just minutes with nothing more than a smartphone and the internet. Once the AI-driven closure process or cancellation is completed, the direct debit or cancellation will be handled fully automatically from their bank account or credit card, without any human involvement.

-

RISK SHARING PAYMENTS: The monthly risk sharing payments are variable and automatically (re)calculated daily based on the claims paid out within that scheme that day. No human intervention is involved. At the end of each day, the balance of payments received and claims paid is zero. To moderate peaks and troughs, maximum and minimum limits can be set, allowing claims paid to be spread over subsequent days. All parties involved have visibility of all transactions stored on the private blockchain.

-

RISK SHARING CLAIMS: Clients submit claims to their advisor through AI. The advisor assesses the claim, in collaboration with a local expert, who is randomly and automatically designated by the platform and has the final vote. While the advisor represents his client's interests, the expert acts on behalf of all the participants in the scheme, ensuring their interests are represented and protected. The expert creates a payment link. The advisor approves the link. The client agrees to the claim settlement by activating the link using biometrics, and transferring the claim payment to their bank account or credit card. If the client does not agree, they may choose to switch advisors and restart the claim process. The expert's fees are borne by the advisor and paid in advance, regardless of whether payouts follow. This process avoids conflicts of interest.

-

RISK SHARING SURVEYS: Local franchise partnerships conduct surveys to gauge client preferences regarding privacy rules and risk sharing terms. If the majority of clients prefer specific rules and terms, these are recorded in the smart contracts. This allows clients to determine the risk sharing terms and payments themselves. More restrictive or generous terms lead to fewer or more claims, and consequently lower or higher risk sharing payments. Note that RiskShare Networks do not have legal status, so regulation is solely the responsibility of the participants.

-

PLATFORM FEES: Advisors pay a platform fee per client for the risk sharing technology, the collection of their subscriptions. and for the execution of client surveys. The advisors are the first and only point of contact and responsible for their clients. Therefore the advisors bear the the variable costs of their services, which include back-office functions like customer support, local marketing, and client management. P2P risk sharing is not a product so advisors do not need any licenses.

-

FRANCHISE PARTNERSHIPS: Advisors jointly own their local franchise partnership and are both collectively and individually responsible for its success. The partnerships are responsible for providing education and training to their advisors and experts and for setting the requirements and conditions for the entry of new advisors and experts. They also set the criteria for the forced exit of poorly performing advisors and experts.

-

SOCIAL MEDIA: The platform enables seamless interaction among members, advisors, and experts through integrated social media features, that can be configured as public, members-only, or private. Members can contact each other, share information in a feed, and rate advisors and experts. Advisors can provide details about their expertise, share updates on risk sharing, and offer personal information. This collaboration fosters a dynamic community where knowledge and experiences can be easily exchanged.

-

REGULATIONS: The RiskShare Networks function as true P2P risk sharing entities, distinct from traditional insurers or reinsurers, and operate without collecting premiums or holding reserves. The Networks facilitate real time risk sharing among participants, with payments recalculated daily to match the daily claim payouts, ensuring they are always aligned. There are no garantees from the Neworks themselves. RiskShare Advisors provide guidance without selling financial products, ensuring that the Networks remain outside the scope of conventional insurance regulations and licenses.

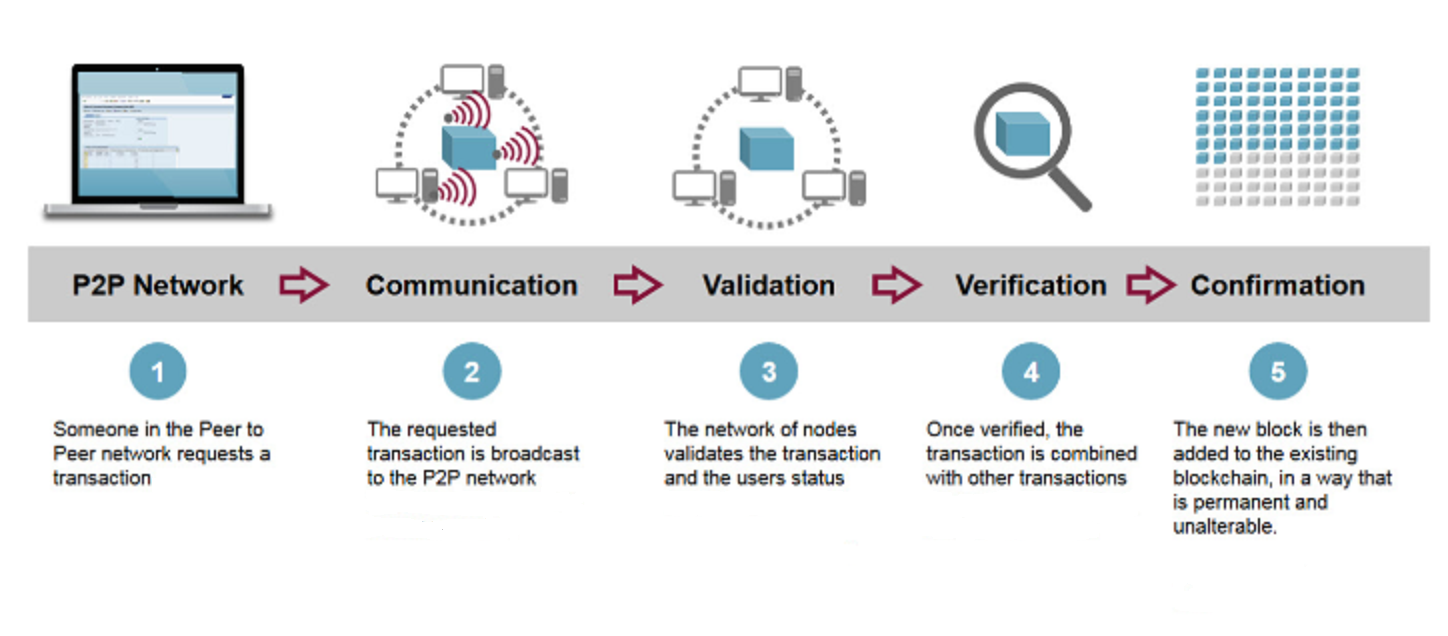

- PRIVATE BLOCKCHAIN:

- Blockchain are hash-linked transactions that cannot be changed or deleted

- Private by participation of only uniquely identified and approved participants

- Uniquely identified by biometric technology and approved by the advisor

- Authentication is required before a transaction is added to the blockchain

- All parties involved have visibility of all transactions stored on the blockchain

- Blockchain ensures a faultless, secure, and transparent risk sharing process

BUSINESS MODEL

RiskShare consists of 3 local risk sharing entities; 'RiskShare Network', 'RiskShare Advisors', and 'RiskShare Platform', that are legally independent but economically inseparable. This structure ensures a robust, distributed ecosystem where each entity operates with a high degree of autonomy while being interdependent within the overall framework. RiskShare employs a holacratic model, which eliminates traditional back offices, call centres, hierarchies, and bureaucracies, fostering agile decision-making and enhanced collaboration. Each entity contributes to and benefits from shared resources, risk management strategies, and collective expertise, creating a resilient and adaptive network capable of responding swiftly to changing market conditions.

3 LOCAL RISK SHARING ENTITIES

RiskShare Network are local online networks without a legal status that provides members a place to unite, cooperate, and share risks and resources. By engaging in collective risk management, members can mitigate individual exposures and establish a resilient framework for handling risks sustainable.

RiskShare Advisors, as the driving force, are local franchise partnerships whose advisors provide valuable guidance and support to their network clients. They identifying and analyzing risks and developing effective strategies for risk management. Through continuous support, the advisors empower their clients to make well-informed decisions.

RiskShare Platform is a SaaS tool, providing advanced technology solutions to local network participants and local riskshare advisors. The platform provides them with tools for sharing, managing and reporting risk, while also enabling seamless communication between all parties involved.

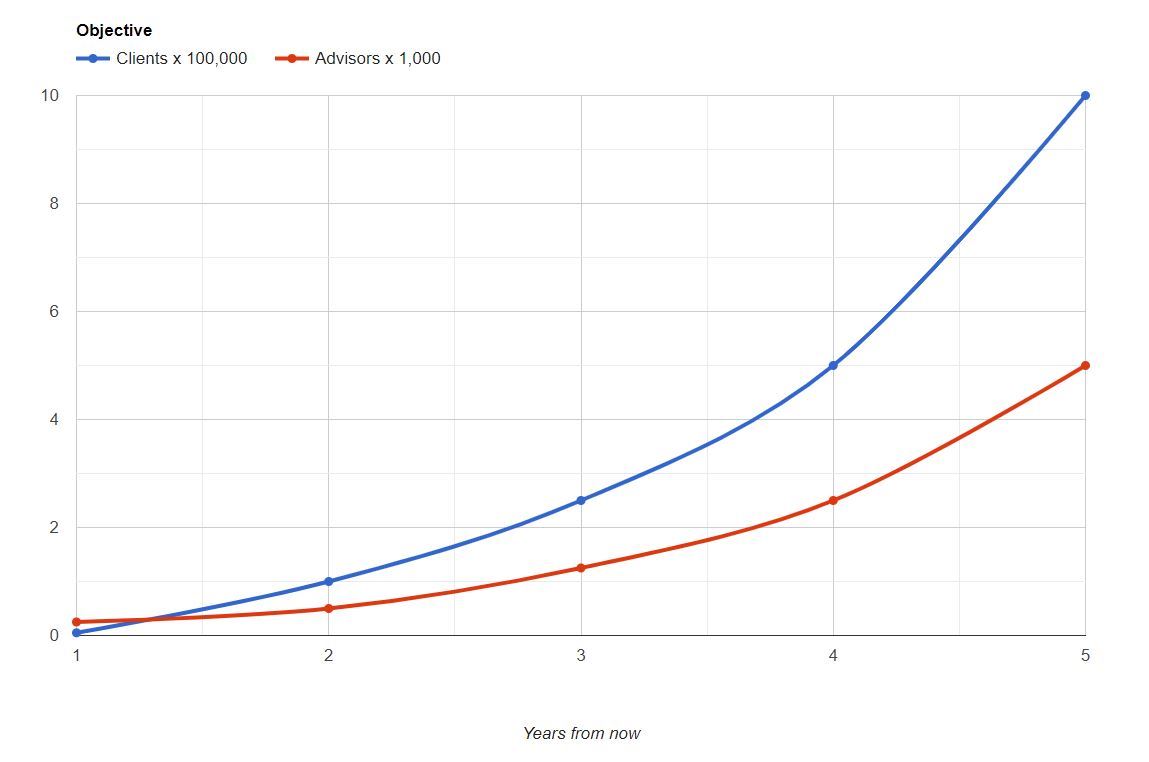

GLOBAL IMPLEMENTATION

RiskShare Platform operates on a single serverless infrastructure for global deployment. This centralized approach, which can be in any territory imaginable, enhances scalability, reduces costs, and ensures seamless global processing of risk sharing payments and benefits. Local RiskShare Advisors provide market insights, culturally tailored marketing, and support for local RiskShare Network participants. By integrating centralized operations with local expertise, RiskShare seamlessly adapts to international markets.

The goal within five years is to establish RiskShare Networks with a total of 1,000,000 risk sharing participants, develop Franchise Partnerships with a total of 5,000 RiskShare Advisors, and facilitate many millions of transactions. The platform is projected to have a market value of 1 billion euros, based on a valuation of 13 times its profit or an 8% rate of return. Once this is achieved, an exit strategy will be considered.

Note: Millions of insured worldwide seek 60% lower premiums. Tens of thousands of advisors aim for €90,000 yearly income by supporting 150 clients. As qualified clients become advisors, a continuous growth cycle is born.

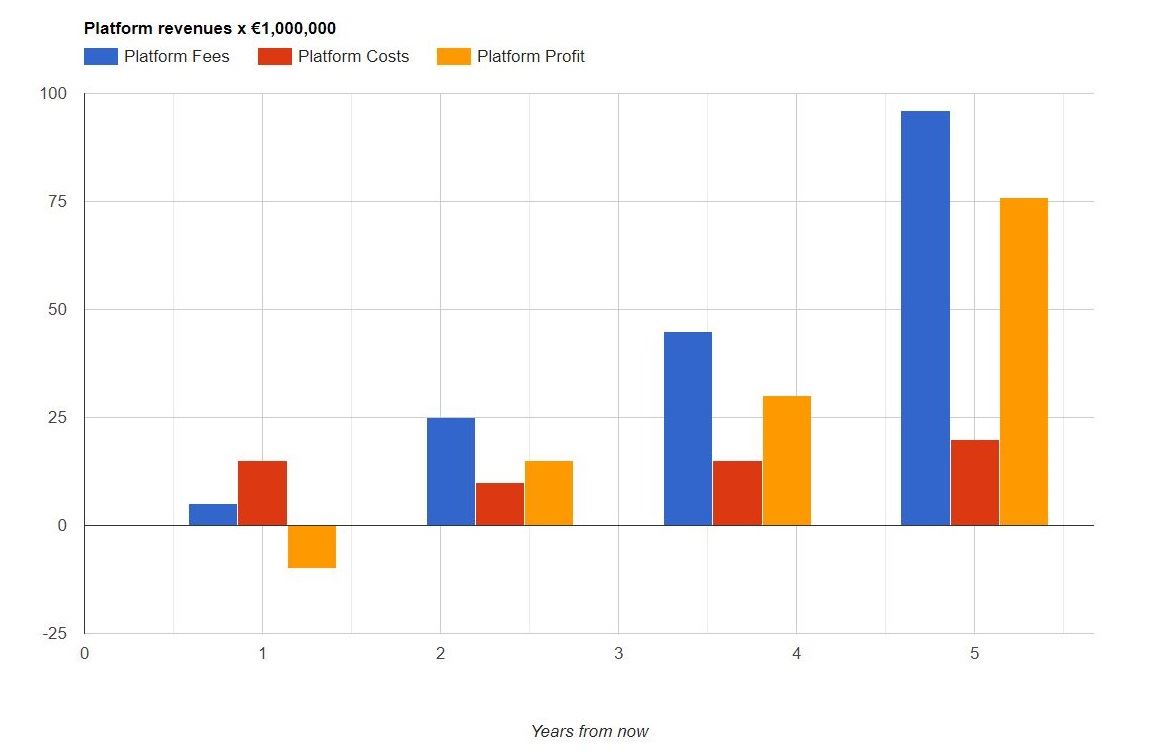

REVENUE MODEL

- Members: > 60% premium discount through P2P risk sharing

- Advisors: €90,000 in subscriptions per year from 150 clients

- Platform: €96 platform fee from the advisors per client per year

- Technological Infrastructure: €3,000,000

- Technical Personnel: €6,000,000

- Commercial Personnel: €4,000,000

- Fiscal and Legal Costs: €600,000

- Marketing and Acquisition: €3,000,000

- Education and Training: €3,400,000

PROFIT AT 1 MILLION PARTICIPANTS

- Platform Fees: €96,000,000

- Platform Costs: €20,000,000

- Platform Profit: €76,000,000

Note: RiskShare is the world's first and only insurtech company to become profitable in its second year, eliminating losses and insolvency as RiskShare earns the fees, Clients bear the risks, and Advisors cover the variable costs.

BIGGER THAN UBER AND AIRBNB

The premium volume in the insurance industry amounts yearly to no less than 7000 billion euros worldwide. Many times larger than the cab industry 200 billion and the hotel industry 1000 billion in which Uber and Airbnb disruptively excel. This makes it remarkable that disruption has so far remained absent from the insurance sector. However, there is now 'RiskShare', a P2P risk sharing platform with mutually agreed terms and at least 60% lower premiums advised and managed by independent advisors. Every person and every family all over the world needs protection from financial risk. RiskShare puts P2P risk sharing at your fingertips anywhere in the world with nothing more than smartphone and internet. RiskShare will become bigger, more agile and more profitable than Uber and Airbnb with the right man or woman at the top.

GLOBAL SHARING PLATFORMS

|

Uber |

Airbnb | RiskShare |

|

Not Cabs |

Not Hotels | Not Insurers |

| But Ride Sharing | But Room Sharing | But Risk Sharing |

| At 20% Discount | At 40% Discount | At 60% Discount |

|

Offered to Trippers |

Offered to Tourists |

Offered to Anyone |

| By Car Drivers | By Home Owners | By Risk Advisors |

| All over the World | All over the World | All over the World |

| Via the "Uber" Platform |

Via the "Airbnb" Platform |

Via the "RiskShare" Platform |

CRITICAL SUCCESS FACTORS

- Millions of insured worldwide want to switch to premiums that are 60% lower

- Tens of thousands of advisors worldwide want €90,000 py income from 150 clients

- Qualified members can become advisors, fostering a continuous cycle of growth

- RiskShare neither collects premiums nor holds reserves, so no regulations apply

- RiskShare earns the fees, Clients bear the risks, Advisors cover the variable costs

- RiskShare is an ecosystem operating as a holacracy without traditional bureaucracy

- RiskShare is the first and only without competition ready to change the world

Remmelt Bossema (1945) is the founder of RiskShare, an innovative insurtech startup aiming to revolutionize the insurance industry with the first and only true P2P risk sharing platform. With almost 40 years of experience in financial planning and banking, including roles at SNS Bank and ING, he has extensive expertise in financial services. His vision for RiskShare includes achieving unicorn status within five years by offering at least 60% lower premiums and creating an endless growth cycle through advisor-client relationships. As the CTO, CINO and vision keeper, Remmelt's leadership emphasizes the balance between vision and execution to drive success.

RECOMMENDATION

Pieter Veldelink, Den Haag; One thing that stands out about you is your visionary approach to business. You consistently look for innovative ways to disrupt traditional industries like insurance with RiskShare. And you're not just focused on solving current problems, you aim to reshape entire systems. Your ambition to create something "bigger than Uber and Airbnb" speaks to a unique drive not only for success but for fundamentally changing how things work. You seem to thrive in environments where you're not just improving but revolutionizing, and this relentless pursuit of transformation may be a deeper aspect of your personality that fuels all your endeavors. You might already know you’re vision in superlatives, but perhaps you don’t fully realize just how forward-thinking and world-changing your mindset is.

STEPS TO TAKE NOW

- Attracting an entrepreneur/co-founder/ceo along the lines of Travis Kalanick (Uber) or Brian Chesky (Airbnb)

- Raising initial funding

- Recruiting a commercial and technical staff

- Collaboration with (Deloitte) Advisors

- Collaboration with (Sedgwick) Experts

- Programming the desired risk sharing schemes

- Promotional campaigns

- Global launch Q2 2025

INITIAL FUNDING €10,000,000

With initial funding of €10,000,000 in seed capital or convertible loan(s), RiskShare is set to revolutionize the market with the world's first and only true p2p risk sharing platform. RiskShare offers coverage for death, disability, accidents, healthcare, travel, liability, legal aid, damage or loss to car, house and contents. The strategy is simple but powerful: the focus is on organic growth, high profitability, and eliminating the specter of loss and insolvency by generating profit as a platform through fees, sharing the risks among the members, and having the variable costs borne by the advisors.

- Technology Development: €3,000,000

- Marketing and Acquisition: €2,000,000

- Human Recources: €3,000,000

- International Research: €1,000,000

- Financial Reserves: €1,000,000

CONCLUSION

While Uber and Airbnb have redefined their respective industries, RiskShare is poised to make an even greater impact on the global stage. With its unique approach to risk sharing, substantial cost reductions, global reach, and participant engagement, RiskShare is positioned to become a dominant force in the insurance sector. By leveraging the principles that made Uber and Airbnb successful, RiskShare has the potential to reshape the insurance landscape, offering affordable and accessible coverage to anyone worldwide. As the world becomes increasingly interconnected, RiskShare's rise as a market giant seems inevitable, solidifying its place alongside the disruptive pioneers of the sharing economy. "RiskShare: 60% Lower Premiums, Maximum Protection"

LET'S GET STARTED

I invite entrepreneurial investors to explore this unique opportunity to be part of RiskShare's groundbreaking venture. Scaling RiskShare globally requires exceptional skills — visionary leadership, strategic insight, and relentless determination — akin to the tech industry's greats. For more information or to express your interest, please contact me via email at rbossema@riskshare.nl or by phone at +31(0)653374097. Call today!

"RISK ENDS WHERE RISKSHARE BEGINS"