SMART CONTRACTS REPRESENT A GROUNDBREAKING TECHNOLOGICAL ADVANCEMENT

Introduction: Smart contracts, built on blockchain technology, have emerged as a transformative force in the world of finance and peer-to-peer (P2P) interactions. One of the remarkable applications of smart contracts is their ability to facilitate seamless and efficient P2P risk sharing. In this article, we explore how smart contracts empower individuals and entities to share risks in a distributed and transparent manner.

Understanding P2P Risk Sharing: P2P risk sharing involves the distribution of risks among a group of participants, allowing them to collectively mitigate the impact of unforeseen events. Traditionally, this process has been associated with insurance and mutual agreements, but the advent of smart contracts has brought a new level of sophistication to this practice.

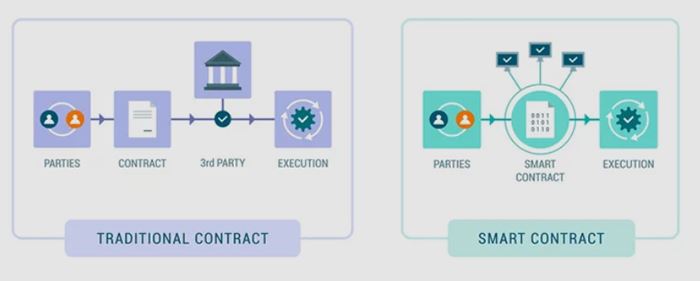

Smart Contracts as Enablers: Smart contracts are self-executing agreements with the terms of the contract directly written into code. These contracts operate on blockchain networks, ensuring transparency, immutability, and distribution. By leveraging these features, smart contracts enable P2P risk sharing in several ways:

-

Distribution: Smart contracts eliminate the need for insurers and reinsurers by operating on distributed blockchain networks. This distribution ensures that P2P risk-sharing agreements are executed without the involvement of centralized authorities, reducing the potential for manipulation or fraud.

-

Transparency: The transparency inherent in blockchain technology ensures that all participants in a P2P risk-sharing arrangement have access to the same information. Smart contracts execute automatically based on predefined conditions, and the details of these transactions are visible to all parties involved. This transparency fosters trust among participants and minimizes disputes.

-

Programmable Logic: Smart contracts allow for the incorporation of programmable logic, enabling customization of risk sharing agreements based on specific conditions. This flexibility ensures that the contract responds dynamically to changing circumstances, enhancing the adaptability of P2P risk sharing arrangements.

-

Automated Payouts: In the event of a predefined triggering event, smart contracts automatically execute payouts to participants according to the agreed-upon terms. This automation streamlines the claims process, reducing delays and administrative overhead. Participants can receive compensation swiftly, enhancing the overall efficiency of P2P risk sharing.

Conclusion: Smart contracts represent a groundbreaking technological advancement that has the potential to revolutionize P2P risk sharing. By combining distribution, transparency, programmable logic, and automated execution, smart contracts offer a robust framework for individuals and entities to collaboratively manage and mitigate risks in a secure and efficient manner. As the adoption of blockchain technology continues to grow, the role of smart contracts in reshaping traditional risk-sharing practices is poised to expand, ushering in a new era of distributed and transparent financial interactions.